Underpayments are one of the most overlooked revenue threats in behavioral health billing. Unlike denials, they do not trigger alarms. The claim shows as paid, and most practices move on. That quiet assumption is where revenue begins to slip away.

Behavioral health services are especially vulnerable. Psychotherapy is time-based. Psychiatry services follow strict documentation and credential rules. Crisis and add-on codes require precise linkage. Small processing gaps lead to reduced reimbursement — and most of those reductions go unnoticed.

Underpaid behavioral health insurance claims are far more common than most providers realize. Even experienced billing teams often fail to audit allowed amounts against contracted rates consistently.

Appealing underpayments is not aggressive billing. It is compliant billing. You are simply requesting the reimbursement your contract already guarantees.

Why Underpayments Happen in Behavioral Health

Underpayments occur frequently in behavioral health because the specialty relies heavily on time thresholds, modifiers, provider credential distinctions, and payer-specific processing rules. When automated systems misapply even one element, reimbursement drops without generating a formal denial.

Common causes include:

Time-Based CPT Downgrades

Psychotherapy codes such as 90834 and 90837 depend on documented minutes. If session time is unclear or processed incorrectly, a 60-minute visit may be reimbursed at the 45-minute rate.

Missed or Stripped Add-On Codes

Crisis psychotherapy add-ons (90840) and prolonged services often require precise linkage. If the system fails to recognize the relationship, the add-on may be paid at zero.

Modifier Misprocessing

Modifiers such as 25, 59, or telehealth modifiers (95/GT) are sometimes bundled or ignored by payer logic, reducing reimbursement without clear explanation on the EOB.

Credentialing File Errors

Psychiatrists, psychologists, LCSWs, and LPCs may be reimbursed at different rates. If the payer’s credential file is incorrect, claims may process at the wrong tier.

Parity Law Misapplication

The Mental Health Parity and Addiction Equity Act requires equal treatment between behavioral and medical services. In practice, some plans still misapply rate logic or limitations.

Telehealth Processing Errors

Incorrect place-of-service coding or modifier logic frequently results in reduced telebehavioral health reimbursement.

Outdated Contract Rates

Payers sometimes apply older fee schedules. Without active contract monitoring, incorrect allowed amounts remain undetected.

In most cases, the claim is marked “paid.” The discrepancy stays buried unless someone compares the allowed amount to the contract.

The Financial Impact of Ignoring Underpaid Claims

Underpayments create slow but compounding revenue loss.

A difference of $15–$20 per psychotherapy session may seem minor. Across hundreds of sessions per month, it becomes significant. For example, if a practice is underpaid $18 on 400 sessions monthly, that equals $7,200 in lost revenue — over $86,000 per year.

Beyond direct loss, underpayments distort financial reporting. Providers appear less productive. Cash flow projections become inaccurate. Contract negotiations weaken because collection data reflects underpaid amounts.

Industry audits suggest behavioral health practices lose between 3% and 7% of annual revenue due to underpayments alone. This revenue was earned. It was simply never recovered.

Appeal Deadlines and Timely Filing Rules

Appeal rights depend entirely on timelines.

Commercial payers typically allow 90 to 180 days from the payment date. Medicare follows a structured multi-level appeal process with defined deadlines. Medicaid timelines vary by state and managed care organization.

Underpayment reviews should occur within weeks of payment posting — not months later. Discovering discrepancies too late eliminates recovery options.

Medicare and Commercial Appeal Levels

Medicare underpayment disputes follow a formal appeal pathway beginning with redetermination, followed by reconsideration, and escalating to higher review levels if necessary.

Commercial plans often require internal reconsideration before progressing to formal appeal stages. Understanding the payer’s appeal structure improves success rates and preserves rights at each level.

Appeals grounded in contract language and payer policy resolve faster than generalized complaints.

CPT Codes Commonly Affected by Underpayments in Behavioral Health

Certain CPT codes are more vulnerable to reimbursement discrepancies:

- 90834 – 45-minute psychotherapy

- 90837 – 60-minute psychotherapy

- 90853 – Group psychotherapy

- 90839 / 90840 – Crisis psychotherapy

- 99213–99215 – Psychiatry E/M services

- 90792 – Psychiatric diagnostic evaluation

Time-based downgrades, add-on stripping, and credential mismatches frequently impact these services.

How to Appeal Underpayments in Behavioral Health Claims

Appealing underpayments requires structure and consistency. The process is straightforward when approached methodically.

Identify the Underpayment

Review paid claims against contracted fee schedules. Compare the allowed amount on the EOB or ERA to the contract rate. Paid does not always mean correct.

Focus first on high-volume psychotherapy and crisis codes.

Confirm Documentation Supports the Service

Ensure session time, medical necessity, and provider credentials fully support the billed CPT code. Appeals succeed only when documentation is defensible.

Review Contract and Payer Policy

Reference the payer’s behavioral health policy, fee schedule, and contract terms. Identify precisely where reimbursement deviates from agreement.

Policy-based appeals are stronger than opinion-based appeals.

Prepare a Clear Appeal Letter

Include:

- Claim number

- Date of service

- CPT codes billed

- Amount paid

- Expected allowed amount

- Contract reference

Attach the EOB, relevant documentation, and contract excerpts. Maintain a professional tone.

Submit Within Timely Filing Limits

Submit as soon as the discrepancy is identified. Late appeals are denied automatically.

Track and Follow Up

Log each appeal with submission date and reference number. Follow up every 30 days if unresolved. Persistence significantly improves recovery rates.

Post Corrected Payment

Once reprocessed, verify that the corrected allowed amount matches the contract before closing the account.

Analyze Patterns

Track recurring discrepancies by CPT code, payer, or modifier. Pattern recognition prevents repeat revenue leakage.

Preventing Future Behavioral Health Underpayments

Recovery is important. Prevention is more powerful.

Most underpayments follow predictable patterns. Identifying them early protects long-term revenue.

Key prevention strategies include:

- Maintaining updated payer fee schedules

- Comparing allowed amounts monthly

- Verifying credential tiering annually

- Standardizing time documentation

- Auditing telehealth and modifier usage regularly

Structured behavioral health revenue cycle oversight creates visibility. Visibility prevents loss.

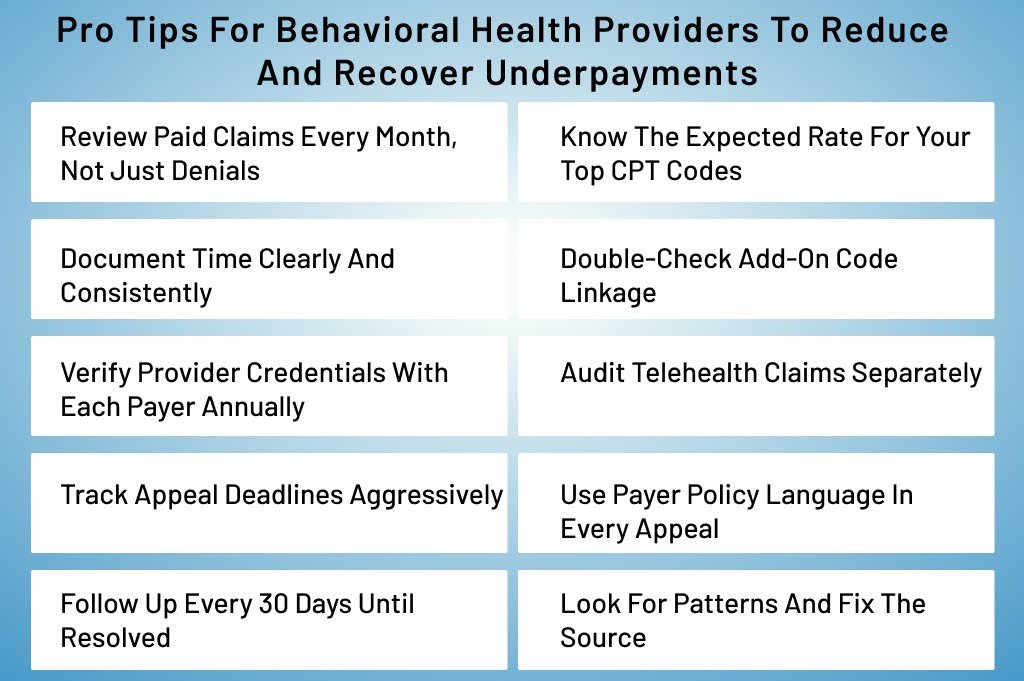

Pro Tips for Behavioral Health Providers to Recover Underpayments

Even when billing is outsourced, providers should understand how their services are reimbursed.

- Review paid claims monthly, not just denials

- Keep a reference sheet of expected rates for common CPT codes

- Document total session time consistently

- Double-check add-on code linkage

- Verify provider credential files annually

- Audit telehealth claims separately

- Track appeal deadlines carefully

- Reference payer policy language in appeals

- Monitor recurring patterns and correct root causes

Small oversight habits prevent large revenue losses.

Conclusion

Underpayments are among the most costly and underestimated issues in behavioral health billing. They reduce revenue quietly while practices remain busy and providers work harder.

Appealing underpaid claims is not about confrontation. It is about compliance and contract enforcement. When practices implement structured review processes, they recover earned revenue without increasing patient volume.

Behavioral health organizations that monitor reimbursement proactively operate with financial clarity and confidence.

Recover Lost Revenue From Behavioral Health Underpayments

Underpaid claims reduce revenue silently. Our mental health billing services include contract rate verification, underpayment audits, structured appeal management, and behavioral health revenue cycle optimization.

If your practice suspects reimbursement discrepancies or contract misprocessing, now is the time to act.

Schedule a Behavioral Health Billing Review and Protect the Revenue You’ve Already Earned.